All About UAN or Universal Account Number of EPF

UAN is the 12 digit Universal Account Number that is allotted to all the employees who are making any kind of contribution to EPF or Employee Provident Fund. The idea behind introducing UAN number is to take the EPF services the online platform and therefore, make the whole process much more user-friendly. The important point to note here is that the UAN number doesn’t change for the employee and remains same throughout the lifetime.

In this post, we have included all the important details about UAN that one needs to know.

How to Know Your Universal Account Number (UAN)?

In order to find out your UAN number, here are two ways:

- Check it with employer: If it is your very first job then once you start contributing towards EPF, UAN number will be notified to you by your employer. Mostly, companies have it printed on your salary slip once the deductions towards your PF start taking place.

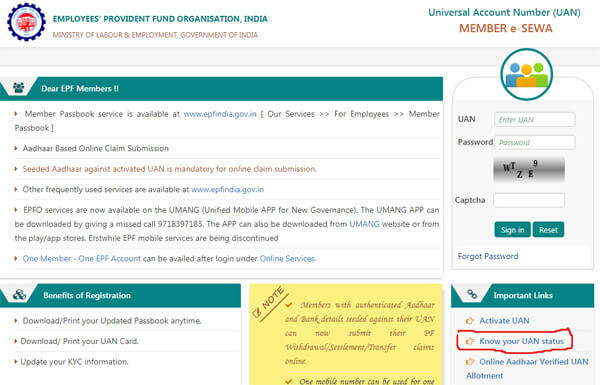

- Check it on UAN portal: In order to check your UAN number, you have to visit the website and or simply click on the link shared below: www.unifiedportal-mem.epfindia.gov.in/memberinterface

Just click on this link and select “Know Your UAN status”. Next, you will be required to fill in your basic details and follow the step-by-step procedure.

Check this: How to get a UAN number through a PAN/ Aadhar/ PF Account number

Need of Universal Account Number (UAN)

- Earlier an employee was allotted different member IDs by different employers for each PF account when a salaried individual made contribution towards EPF.

- On October 1st, 2014, PM Narendra Modi made the whole process a lot simpler by bringing down all the PF accounts under one number.

- Having just one UAN number makes it much more sorted and convenient to manage your EPF.

Documents Required For Generating UAN

Here is the list of documents that are required for generating UAN from anywhere:

- Bank account details that include your bank account number, branch name and IFSC code

- ID proof that can include any of the following- Driving license, Aadhaar card, Voter ID, Passport etc.

- Address Proof which can be in any of the ID proofs mentioned above or your ration card.

- ECIS card, in case you already have an account.

- Aadhaar card and PAN card.

Benefits of Universal Account Number (UAN)

Here are some of the advantages associated with UAN. They are:

- You can link all your previous PF accounts under one UAN number.

- You can download updated EPF passbook.

- You can make changes in your personal contact details.

- You can conveniently upload KYC data.

- You can have your UAN login, EPFO login on UAN activation.

- You can also apply for online transfer of PF.

Allotment of UAN For New Employee

- UAN number is allotted by EPFO i.e. Employment Provident Fund Organization.

- It is allotted when the employer submits the request for UAN number for an employee.

- Details of UAN ae provided to the employer

- Employer is required to communicate the UAN along with member ID to the particular employee.

Categories: Others Tags: UAN, UAN Number, Universal Account Number

How to get a UAN number through a PAN/ Aadhar/ PF Account number

The universal account number (UAN) is given to every employee working in a registered company of India. UAN number is necessary for checking EPF balance. If UAN number is not known then UAN number can be obtained by registering in Unified Member Portal and EPFO Unified Portal. Every employee who is working in a registered company in India, makes some contributions from monthly income to provident fund. This PF amount is linked to unique account number by Employee. The employee has many benefits by saving in EPF. With the help of UAN, an employee can check the status of his EPF balance, transfer or withdraw the amount saved in PF. Sometimes the employee forgets his UAN and tries to get it from PAN or Aadhar card number He will have many questions and queries regarding how to get UAN from PAN.

Generate UAN Number From PAN & PF Number { Immediately }:

Every employee who works in registered office in India ill have PF account. He will be asked to submit his/her PAN number for taxation purpose. This PAN number will be linked to UAN number. If the linkage is not done, it is not possible to get UAN number. Usually the payroll department of the employer takes care of all this procedure.

Steps To Get UAN Number From PAN Number:

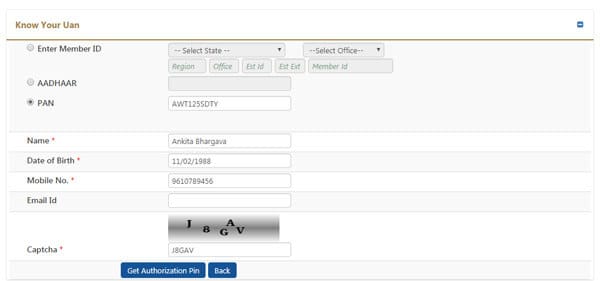

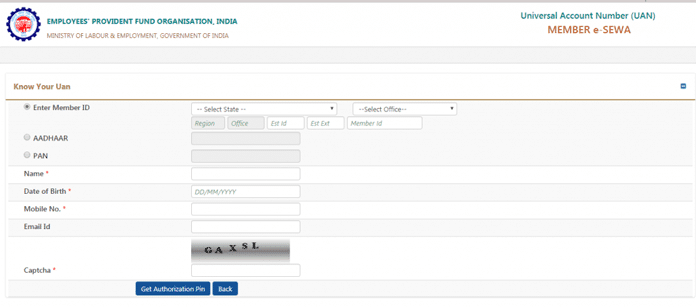

Step 1: Login to UAN member portal and select know your UAN status on home page.

Step 2: You will get different options to get UAN through PAN or Aadhar card or PF number. Select PAN and enter PAN number and other details.

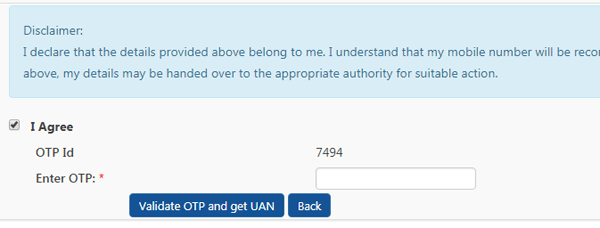

Step 3: Click on get authorization Pin, then you will receive OTP to the registered mobile number. Enter OTP and click on validate and get UAN.

Forgot UAN Number

There is every possibility that you may forget your UAN number. Then the question arises what to do.

1. If your UAN is activated, and you have updated your mobile number for provident number then you can give a missed call to this toll free number 011-22901406. EPFO will send all your credentials in SMS.

2. Your employer will definitely have your UAN number. Reach out to him and ask for UAN number.

3. Go to EPFO site. Under “Our services” option, click on for the employees option and then click on UAN helpdesk option. You will be directed to another page, where you have to define your problem, provide updated mobile number and PAN details. A OTP will be generated and sent to your mobile number, which has to be filled on the portal in the given space. You will receive an application id. EPFO will resolve your problem and will send UAN number and details to your mobile number.

How to Generate UAN Number

Every employee working in any registered company in India will have a UAN linked to his PAN card. If your company has not given or has not generated, you can generate UAN number yourself.

Step 1: Visit the official website of EPF Unified portal EPF Portal (http://www.epfindia.com/site_en/)

Step 2: Click on the establishment registration

Step 3: Fill up the complete form

Step 4: Enter words from Captcha

Step 5: Check the declaration and click on Registration button.

Step 6: You are done, the process is complete.

UAN Members EPFO Services Check UAN Status

Every employee can check the status of UAN online. Go to the EPFO portal. Select your state and provide the EPFO account number to check UAN status.

Employee UAN Number Download

Initially the UAN was allotted to all the EPF members. But subsequently the UAN is being allotted by the EPFO to the new members on the declaration of the employers. This list is available in UAN menu of OTCP. Employers have to download the list and pass on the UAN number to its employees. When the download UAN list button is clicked, a screen will appear and the employer can view and download the UAN in PDF format. There are five options given to the employer to download:

- UAN List (Ascending order of member ids)

- UAN list (Descending order of member ids)

- UAN list (order by UAN creation date)

- UAN list (for distribution to members)

- UAN list (for distribution to members)

Categories: Others Tags: Employee, UAN Number